How to Register a SaaS or IT Company in Singapore: The Complete 2025 Guide

In 2025, Singapore continues to shine as Asia’s Silicon Gateway, a strategic hub where technology, innovation, and business are seamlessly expanding their wings. For SaaS founders, IT consulting firms, cloud service providers, and digital entrepreneurs, proceeding with company registration in Singapore is not just a formality. Instead, it’s a calculated move to tap into one of the world’s most business-friendly environments.

With its strong legal foundation, stable economy, forward-thinking government policies, and strong IP protection laws, Singapore consistently ranks among the top destinations for tech-driven businesses. According to ACRA’s 2025 Business Registry Statistics, foreign tech company registrations have grown by over 40% year-on-year, showing how strongly international entrepreneurs trust Singapore as their base for Southeast Asia and beyond.

In this guide, we’ll walk you through everything you need to know, like understanding the documents required, the step-by-step registration process, and the specific benefits for SaaS and IT businesses.

Choosing the Right Business Structure for Your SaaS/IT Company

Before diving into the process of company registration in Singapore, it’s essential to understand the various business structures available in Singapore. Moreover, this step is crucial as choosing the right structure can influence your tax liabilities, compliance requirements, and the ability to raise capital.

In Singapore, the main business structures include:

-

Sole Proprietorship

A sole proprietorship is a business owned and operated by one individual and offers no legal separation between the owner and the business.

-

Partnership

Owned by two or more individuals or entities, this form of partnership can be of different types, like General Partnership, Limited Partnership (LP), or Limited Liability Partnership (LLP).

-

Private Limited Company (Pte Ltd)

The most popular form of business for IT and SaaS founders in Singapore is a private limited company. It offers limited liability to shareholders, a separate legal identity, and easier access to foreign funding and tax incentives.

-

Branch Office

A branch office is suitable for foreign companies looking to expand without incorporating a new entity. However, a branch is not considered a separate legal entity from its parent company.

-

Representative Office

In this business model, entrepreneurs or business owners forming a representative office will not be allowed to conduct profit-generating activities; however, this is often used by foreign companies to explore business opportunities before a full-scale launch.

Thus, it is important to understand these structures to help entrepreneurs select the one best suited for their long-term vision, risk appetite, and operational needs.

Costs for Setting Up the IT Company in Singapore

The company registration in Singapore involves an estimated government fee which is approximately 315 SGD. In addition, the other costs associated with setting up the IT company in Singapore, like professional fees, vary based on service providers and company complexity.

Documents Required to Register an IT Company in Singapore

Before delving into the step-wise processes and initiating any business registration process, you’ll need to prepare and submit several key documents, which are mentioned below:

- Proposed Company Name, which must be approved by ACRA

- Company Constitution, which is formerly called Memorandum & Articles of Association

- Details of Shareholders or stakeholders comprising a minimum of one shareholder, individual, or corporate

- Details of Directors: at least one director must be a resident of Singapore

- Registered Business Address in Singapore

- Share Capital Details with a minimum limit of SGD 1

- The Company Secretary must be appointed within 6 months of incorporation

Note that all documents you submit must be accurate, properly formatted, and translated into English if originally in another language.

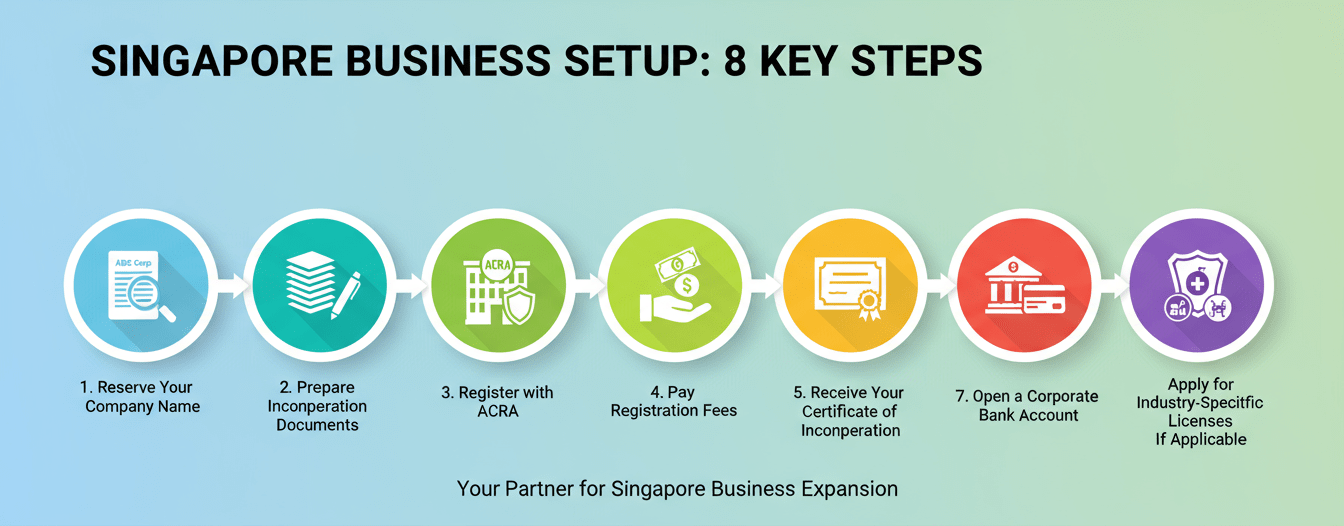

Step-by-Step: Registering a SaaS or IT Company in Singapore

While the process of company registration in Singapore is famously straightforward, SaaS and IT founders should approach it strategically because the choices you make now will impact fundraising, tax optimisation, IP protection, and compliance for years to come.

Here’s the deep-dive, founder-friendly guide:

Step 1: Reserve Your Company Name

The first step involves choosing a unique, brand-relevant company name and submitting it to the Accounting and Corporate Regulatory Authority (ACRA) via the BizFile+ portal. The name must not be identical or too similar to existing businesses, infringe trademarks, or contain vulgar/restricted words.

Moreover, this process is usually approved within hours, but if flagged for review, e.g., financial services SaaS needing MAS clearance, it can take up to 2 weeks.

Why It Matters for SaaS/IT Companies:

Your company name becomes part of your legal and digital identity, and it appears in contracts, billing, investor agreements, and IP filings. In addition to this, for SaaS products, name alignment is crucial if you plan to trademark your software brand or register a .com / .sg domain.

Step 2: Prepare Incorporation Documents

In this step of business registration Singapore, you should gather all required documentation, like :

- Company Constitution (formerly Memorandum & Articles of Association).

- Shareholder Details (at least 1 shareholder; can be individual or corporate).

- Director Details (minimum 1 resident director).

- Registered Singapore Business Address.

- Share Capital details (minimum SGD 1, but higher is better for funding optics).

Company Secretary (must be appointed within 6 months).

Step 3: Register with ACRA

In this step, submit your registration application and documents via BizFile+ and pay the official incorporation fee. Once done, wait for the Certificate of Incorporation from ACRA, which may take up to 2 to 3 weeks if any additional regulatory clearances are required.

Why It Matters for SaaS/IT Companies:

Only after incorporation can you sign customer contracts, raise capital, open a corporate bank account, and legally own IP in Singapore. The date of incorporation often becomes your startup’s “official” founding date, which becomes useful for PR, pitch decks, and anniversary campaigns.

Step 4: Pay Registration Fees

Once done with initiating the registration process, pay a nominal fee for name reservation and company incorporation separately via BizFile+. While the fee is minimal, payment officially locks in your incorporation request that ensuring non-claimance of your business name during the process.

In addition, make sure that your payment receipt is stored with your startup’s incorporation documents for audit purposes and due diligence in the future.

Step 5: Receive Your Certificate of Incorporation

At this stage of company registration in Singapore, ACRA will email your Incorporation Certificate once approved. Moreover, you can request a hard copy for a nominal fee. The importance of this document is immense as this certificate proves the legal existence of your business, which is effective for opening a bank account, signing contracts, and even registering IP rights.

Step 6: Register for GST (If Required)

This step is optional for a few IT founders, as if your annual turnover is expected to exceed SGD 1 million, you must register for Goods and Services Tax (GST). Many B2B SaaS companies hit the GST threshold faster than expected due to annual subscription billing models. Moreover, being GST-registered can increase credibility with enterprise customers who expect tax-compliant invoicing.

A pro tip for tech founders is that, in case of non-mandatory, a voluntary GST registration can improve cash flow and perceived professionalism.

Step 7: Open a Corporate Bank Account

Once registered, proceed to open a corporate bank account in Singapore. Moreover, it is important to note that most banks require the physical presence of directors during the process.

Step 8: Apply for Industry-Specific Licenses (If Applicable)

Certain business activities require additional licenses (e.g., food & beverage, finance, healthcare). Hence, before initiating the process of registration, it is important to identify if your business falls under any regulated sector. In the case of the SaaS/IT sector, most companies don’t require extra licensing, provided there are some exceptions:

- Fintech SaaS – May require Monetary Authority of Singapore (MAS) licensing.

- Healthcare SaaS – May require Ministry of Health (MOH) clearance.

- Cybersecurity SaaS – May require approval under the Cybersecurity Act.

It is important to note that operating without required licenses can invalidate customer contracts and result in penalties.

Why Singapore is the Ultimate Hub for SaaS & IT Entrepreneurs?

While many countries offer startup-friendly policies, Singapore offers a rare combination that makes it uniquely attractive for technology companies:

1. Strong Intellectual Property (IP) Protection

For SaaS and IT companies, your code, algorithms, and data are your crown jewels. Singapore’s IP laws are globally respected, giving you peace of mind that your software, brand assets, and proprietary technology are safeguarded.

2. Unmatched Global Connectivity

Positioned at the heart of Asia, Singapore offers quick access to fast-growing markets like India, China, Australia, and ASEAN nations. Changi Airport connects to over 100 countries, and the Port of Singapore is among the busiest in the world, making it ideal for companies offering cloud services, global IT consulting, and cross-border SaaS solutions.

3. Pro-Startup Government Initiatives

Schemes like Startup SG, the Enterprise Development Grant (EDG), and Productivity Solutions Grant (PSG) directly support product development, R&D, and overseas market expansion, crucial for SaaS scale-ups and IT innovators.

4. A Deep Pool of Skilled Tech Talent

Singapore attracts top-tier talent in software engineering, AI, cybersecurity, cloud computing, and data science. Moreover, English being the primary business language removes communication barriers for global teams.

5. Low and Transparent Tax Regime

Corporate tax is capped at 17%, with tax exemptions for startups and incentives for R&D. Also, the Inland Revenue Authority of Singapore (IRAS) operates with transparency and efficiency, minimizing compliance headaches.

How Taxmantra Global Assists Companies in the Registration Process in Singapore

Navigating the intricacies of business registration Singapore, compliance, and ongoing governance can be overwhelming for a tech-based founder. This is where Taxmantra Global becomes a crucial partner.

Here’s how Taxmantra Global adds value:

- Tailored Consultation: Advises on the best business structure and entity type suited for your industry and goals.

- Name Reservation & Documentation: Manages ACRA filings and drafts essential incorporation documents.

- Nominee Director Services: Provides reliable local directors if required to meet legal requirements.

- Company Secretary Services: Ensures timely compliance with regulatory obligations.

- Bank Account Assistance: Coordinates with leading banks to simplify account setup.

- Licensing and Tax Registration: Assists with obtaining relevant licenses and registering for GST.

- Post-Incorporation Support: Offers bookkeeping, payroll, tax filing, and business advisory services.

With deep expertise in cross-border structuring and regulatory compliance, Taxmantra Global helps IT founders and entrepreneurs avoid costly mistakes and focus on scaling their ventures.

Final Thoughts

To conclude, Singapore’s welcoming business environment, strong legal system, and global connectivity make it an ideal destination for entrepreneurs and companies looking to set up their IT/SaaS companies in Asia. Hence, the process of company registration in Singapore is not just a strategic move; it’s an investment in stability, scalability, and success.

While the process is relatively straightforward, aligning with experienced professionals like Taxmantra Global ensures you start your business on solid ground, remain compliant, and maximize tax and operational efficiencies.

So whether you’re a solo entrepreneur, a growing startup, or an established enterprise, now is the time to leverage Singapore’s advantages and take your business global.

Tags: Company Registering Cost Singapore, Company Registration, Company Setup in Singapore, IT Company Registration Singapore, SAAS Company Registration, Settingup IT Company in Singapore, Singapore Company Registration, Singapore Company Setup