Don’t want to get taxed twice? Use the POEM test!

Don’t want to get taxed twice? Use the POEM test!

Running a global business is a dream, but tax headaches can turn that dream into a nightmare.

Ever wondered where your overseas company actually pays taxes?

That’s where POEM comes in.

Global entrepreneurs need to understand the concept of Place of Effective Management (POEM).

It’s an internationally accepted test that determines the tax residency of your company incorporated overseas. In simpler terms, it dictates where you pay taxes.

POEM is crucial because it determines the location of your company’s management and, consequently, the tax rate you pay. The concept has been implemented in India since April 1st, 2017.

A clear understanding of POEM helps entrepreneurs ensure compliance with tax requirements. This is especially important if your company’s turnover exceeds a certain threshold and falls under the factors used to determine POEM.

Does POEM Apply to Your Business?

The first and most important factor for POEM applicability in India is your company’s turnover. POEM only applies if your company’s turnover in a financial year exceeds Rs. 50 Crores.

Identifying Active Business Management Outside India :

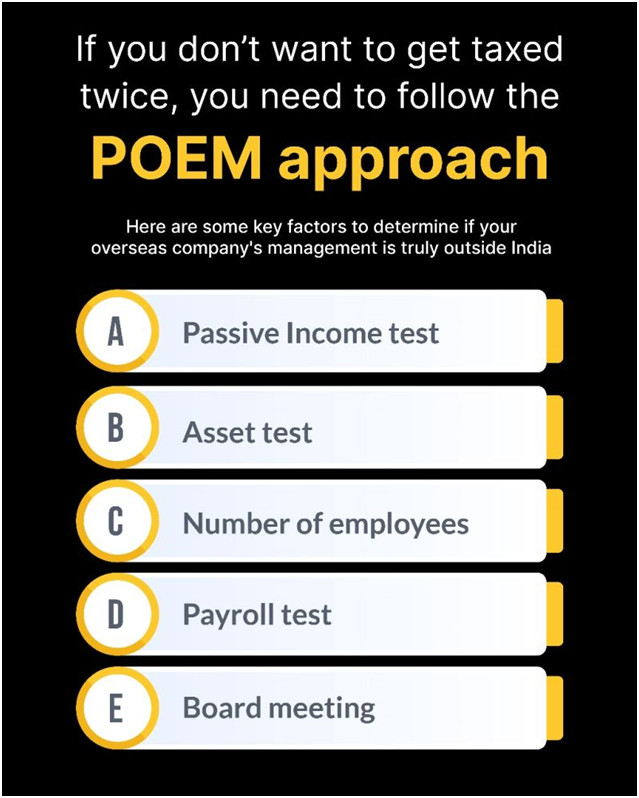

Here are some key factors to determine if your overseas company’s management is truly outside India:

a. Passive Income test: Less than 50% of your company’s total income comes from passive sources

b. Asset test: Less than 50% of the company’s assets are situated in India.

c. Number of employees: Less than 50% of its total number of employees is situated in India.

d. Payroll test: Payroll expense on employees in India is less than 50% of total payroll

expenses.

e. Board meeting: Majority of the board meetings are taken outside India.

For the purpose of the above calculation, the average of the last three year’s data is to be considered.

If the company is less than three years old then such a lesser period can also be considered. Nevertheless, such tests have to be conducted on a year to year basis which will eventually determine the management’s control of the company incorporated outside India.

By understanding POEM, entrepreneurs can proactively manage their tax obligations and ensure compliance, ultimately supporting their global business growth.

Have you ever been in a situation like this?