A Guide to Getting Ready for Financial Due Diligence

Imagine you have found your dream house, which ticks all the points on your checklist. However, before signing the paper, you decide to conduct one last check by hiring an expert. With this expert guidance, you locate a faulty foundation in the house, which would likely make a huge dent in your pocket in the near future. This situation depicts the importance of financial due diligence in any Merger and Acquisition (M&A) transaction that helps make or break a deal. This blog specifies the essential steps involved in preparing financial due diligence and a step-wise guide of the entire process.

What Is Financial Due Diligence?

Financial due diligence is the process of delving deeper into the financial health of a company to understand any hidden liabilities, etc. during M&A. In other words, this process involves reviewing the company’s financial statements, such as income statements, balance sheets, and cash flow reports, to assess its health and understand the risks involved.

During the buying and selling of the company, this process is conducted by the accountants, financial analysts, or independent auditors who also go through past tax filings to make informed decisions.

Essential Steps in Preparing for Financial Due Diligence

Here are the step-wise guides to follow the preparation of FDD:

Step 1: Assemble All Financial Documents

The first step in preparing due diligence is organising all the documents and ensuring that these records are accurate and up-to-date. For ease of assembling, you can categorise the documents into segments which are as follows:

- Registration Documents: This includes documents pertaining to a copy of PAN/TAN, registration certificate of VAT, Certificate of Incorporation, Service Tax, GST, etc.

- Documents Containing General Information: This general information involves all the founder’s agreements, patents, and other legal documents. In addition, other important general information including a detailed profile of the customer base and a list of all the product offerings both existing and under-developed should be kept organised.

- Financial Information: This involves organising financial reports and statements like profit and loss account statements, balance sheets, shareholding details, etc.

- Taxes & Compliance: This segment mostly includes all copies of tax returns, GST filing, assessments, notices, or any penalties from the authorities.

Step 2: Evaluation of Assets and Liabilities

Under this step, it is important to identify and evaluate the assets and liabilities of the company including both tangible and intangible assets.

Step 3: Assessment of the Performance of the Company

This step involves a thorough analysis of the company’s performance to understand the trend in revenue, past expense patterns, and profitability.

Step 4: Know the Financial Status

Knowing every aspect of the finances including revenue streams, past expenses, and cash flow. Thus before the FDD takes place, knowing your numbers and offering the right justification is necessary.

Step 5: Store Your Data Safety

In order to organise all these confidential documents safely in one place, company owners can also design a secured online space. This online space can not only be used to store these financial documents but can also be shared with potential investors.

Step 6: Address Potential Loopholes or Risks

Before the process of FDD kicks in, it is recommended to settle any outstanding debts, penalties, or tax discrepancies. Thus the systematic organisation of these documents ensures smooth and seamless completion of the due diligence process.

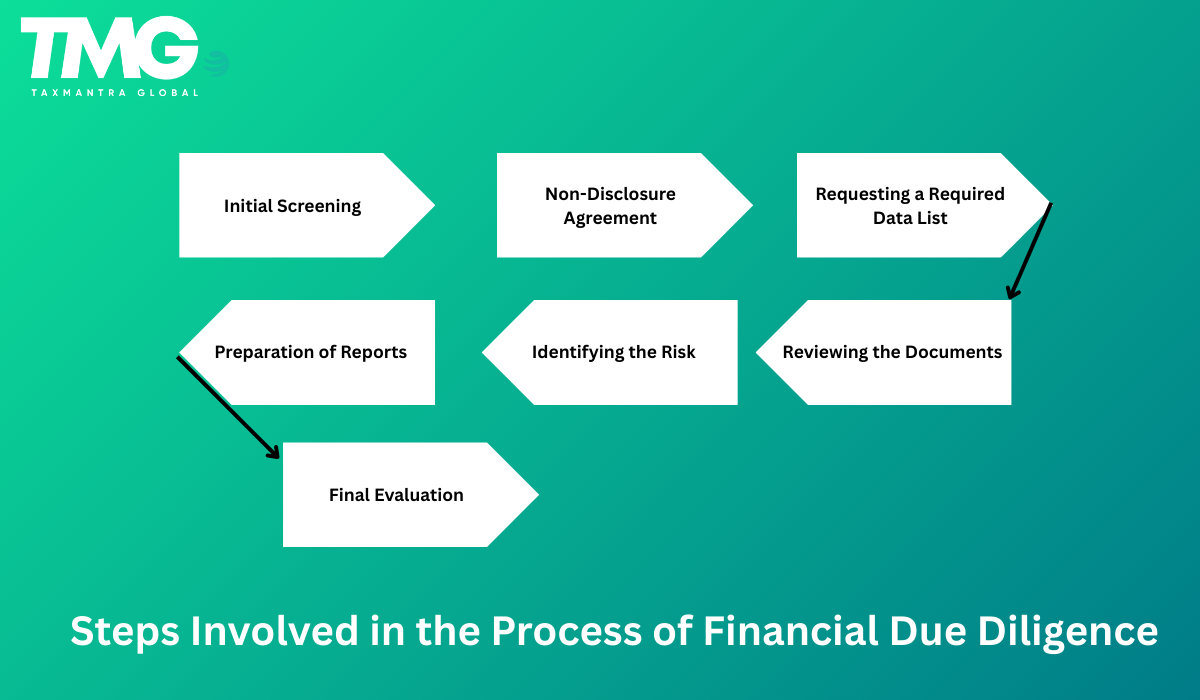

Steps Involved in the Process of Financial Due Diligence

Generally, the process of financial due diligence takes about 4 to 6 weeks to complete, however, this timeframe may vary as per the complexity of the finances. Irrespective of the time taken, the process must be carried out systematically. Here are the step-by-step guides involving the process of due diligence:

-

Step 1: Initial Screening

In this primary step, the potential investors would conduct a preliminary review of the company’s financials. This offers a clear image of whether the company’s financial status will meet its investment objectives.

-

Step 2: Non-Disclosure Agreement

This step is quintessential and involves signing an NDA between the company and its potential investors before the sharing of confidential financial information.

-

Step 3: Requesting a Required Data List

In this due diligence process, the investors or auditors will send a requisite for a detailed list of documents needed, hence staying prepared involves a seamless approach.

-

Step 4: Reviewing the Documents

During this step, the auditors or investors conduct a thorough scrutiny of the financial documents presented to gain a complete understanding of the company’s financial health.

-

Step 5: Identifying the Risk

Once a thorough review of the documents is performed, the due diligence team will be able to locate the existing and potential risks. This mostly includes finding out any outstanding debts, fiscal liabilities, or legal disputes that already exist, costing fortunes in the future.

-

Step 6: Preparation of Reports

In this step, the team of reviewers prepares a report stating their analysis, findings, potential risks, and recommendations. For instance, they will identify any discrepancy present in the horse rent allowance and will explain how it has affected the tax calculation. Not only this, they will also propose any solutions to ensure that the disputes are rectified.

-

Step 7: Final Evaluation

Lastly, this step involved investors understanding the reports presented by the due diligence team and making decisions on whether they would invest in the company.

In conclusion, this report offers adequate transparency to the investors and makes them feel confident in their investment decisions.

Why Choose Taxmantra Global to Simplify Financial Due Diligence?

With the growing complexities in the legal, financial, and statutory areas, companies may face a myriad of challenges in the financial management process. Moreover, financial due diligence being one of the most essential processes before buying and selling of companies needs to be accurate and precise.

To mitigate this, Taxmantra Global offers assistance in maintaining accurate financial records and generating statements promptly. From complicated tax filing to tracking a company’s financial health, these industry experts function with efficacy. Thus, by conducting the complex work seamlessly, we ensure companies focus better on their investors and growth.

Tags: Essential Steps for Financial Due Diligence, Financial Due Diligence, Financial Due Diligence Process, Taxes & Compliance