A Comprehensive Checklist For Business Setup in USA

Due to its robust infrastructure, large consumer base, and start-up-friendly policies, the business market in the USA attracts hundreds of business founders and entrepreneurs to set up businesses here. Despite offering a fertile ground for innovation and growth, certain complexities in business formation, compliance, and legal requirements are challenging to navigate without guidance. For clear understanding, this blog offers a clear checklist for a business setup in the USA, irrespective of any industry, location and types of business.

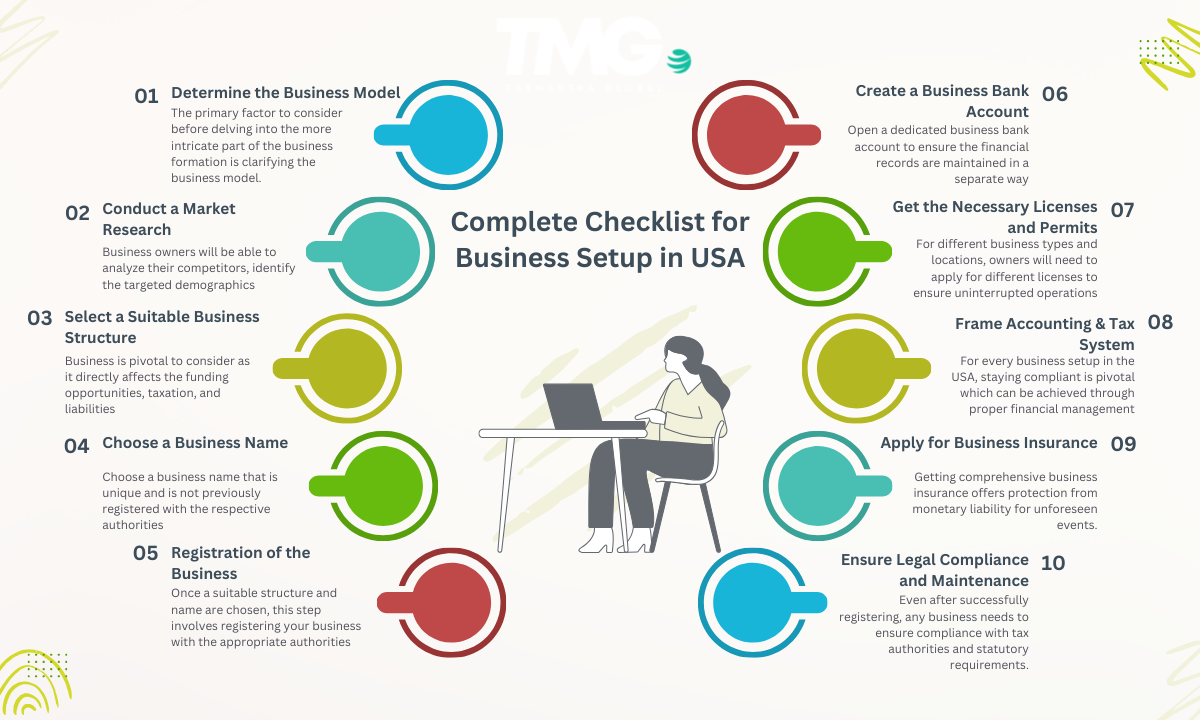

Complete Checklist for Business Setup in USA

Here is a complete checklist that every entrepreneur and business owner must follow while proceeding with the business setup in USA:

-

Determine the Business Model

The primary factor to consider before delving into the more intricate part of the business formation is clarifying the business model. This decision can be better taken if business owners can answer the following questions for themselves:

- What problem does the business solve?

- Who is the target customer?

- Does the business deal in the transaction of products or services?

- What is the target market -B2B or B2C?

Based on these answers, businesses can choose from the most suitable models. These are sole proprietorships, LLCs including small or medium eCommerce businesses, corporations (C-Corp or S-Corp), and franchises.

-

Conduct a Market Research

This step is crucial irrespective of business type and involves conducting thorough market research by comprehending the market landscape. Once this research is performed, business owners will be able to analyze their competitors, identify the targeted demographics, and know industry trends and growth potential.

-

Select a Suitable Business Structure

The legal framework of the business is pivotal to consider as it directly affects the funding opportunities, taxation, and liabilities. The different business structures include:

- Limited Liability Company (LLC)- This is the most common type of business structure and acts as a hybrid model for corporation and partnership.

- C-Corporation- The C-Corp model is ideal for large corporations as it involves double taxation, however, offering maximum protection to the shareholders.

- S-Corporation – This structure of business is ideal for small companies having less than 100 shareholders offering subsequent tax benefits and limited liability.

- Sole-proprietorship or partnership – Unlike corporations or LLCs, the owners and partners bear unlimited risks and liabilities.

-

Choose a Business Name

In this step, choose a business name that is unique and is not previously registered with the respective authorities. Moreover, the name must be aligned with the brand identity to serve relevance to the shareholders, investors, and customers.

Founders and entrepreneurs can check the name availability from the official website of the Secretary of State.

-

Registration of the Business

Once a suitable structure and name are chosen, this step involves registering your business with the appropriate authorities. Here is the list of authorities to register with:

- Articles of Organization – applicable for LLCs filing

- Articles of Incorporation – applicable for corporations filing

Upon registering the business, business owners must apply for an Employer Identification Number (EIN) which acts as a social security number for any business operating in the U.S.

-

Create a Business Bank Account

Open a dedicated business bank account to ensure the financial records are maintained in a separate way from that of your personal bank account. In addition, having a separate business bank account would ensure business builds credit, makes accounting easier, and adds credibility to the operations.

In order to open a business bank account, most banks would request an EIN and other related business formation documents.

-

Get the Necessary Licenses and Permits

For different business types and locations, owners will need to apply for different licenses to ensure uninterrupted operations. Some of these permits include:

- Federal licenses – required for businesses dealing in alcohol, firearms, etc.

- State licenses – required for contractors and medical professionals.

- Regional permits – includes health permits, zoning permits, etc.

-

Frame Accounting & Tax System

For every business setup in the USA, staying compliant is pivotal which can be achieved through proper financial management. For this reason, track income, expenses, payroll, and taxes periodically to stay aligned with your financial goals.

In addition, it is quintessential to decode the federal, state, and local tax obligations from time to time to avoid any penalties and tax disputes.

-

Apply for Business Insurance

Getting comprehensive business insurance offers protection from monetary liability for unforeseen events. Based on the industry type, business owners may need to apply for:

- General Liability Insurance

- Professional Liability Insurance

- Workers’ Compensation

- Commercial Property Insurance

To obtain comprehensive coverage that suits the business model, consult with a reputed insurance provider.

-

Ensure Legal Compliance and Maintenance

Even after successfully registering, any business needs to ensure compliance with tax authorities and statutory requirements. Here are the following legal preconditions to adhere to:

- a) Systematically file reports with the state authorities

- b) Process the renewal of important permission letters whenever required

- c) Make filing of the taxes before the due date.

-

Protect Intellectual Property

If the business delves into the creative domain, unique branding, or inventions that need to be protected from copyright infringement, then the following precautions must be taken:

- Opt for trademarking to protect the business branding

- If the company deals in inventions, file for patents

- To protect content and designs, use copyrights

You can approach the U.S. Patent and Trademark Office (USPTO) which handles trademarks and patents.

Final Takeaways: Partner with Expert Consultants like Taxmantra Global

Starting a business involves utmost perseverance and preparation. However, considering the complexity of the US business landscape, it can be a legal and administrative challenge for entrepreneurs and first-time founders to navigate.

That’s where expert legal and advisory consulting agencies like Taxmantra Global guide through the entire business setup in the USA – from company formation to offering cross-border tax advisory and regulatory support.

Irrespective of any type of company formation from India or need assistance with a business permit, the global team ensures that your setup is compliant from the first day onwards.

Tags: Business Setup in USA, Checklist for Business Setup, Checklist for Business setup in USA, USA Business Setup